There’s a chill in the air and the number of spooky decorations throughout the neighborhoods is increasing as we approach Halloween. We’re sure most of you have had some sort of pumpkin spiced flavored something - it must be October! We’ve just reviewed the latest batch of market data and there are some great takeaways. Please read below in this longer than normal market update email for our thoughts on this transitioning market.

Thank you,

Adam, Wendy and Kat

Brief Summary

-

2022 is not 2008

-

Pricing! Where are we now? Median price on relative basis

-

Ch-ch-ch-changes in market dynamics - list price, DOM, overbidding

-

Are we inching towards…normal?

1. 2022 is not 2008

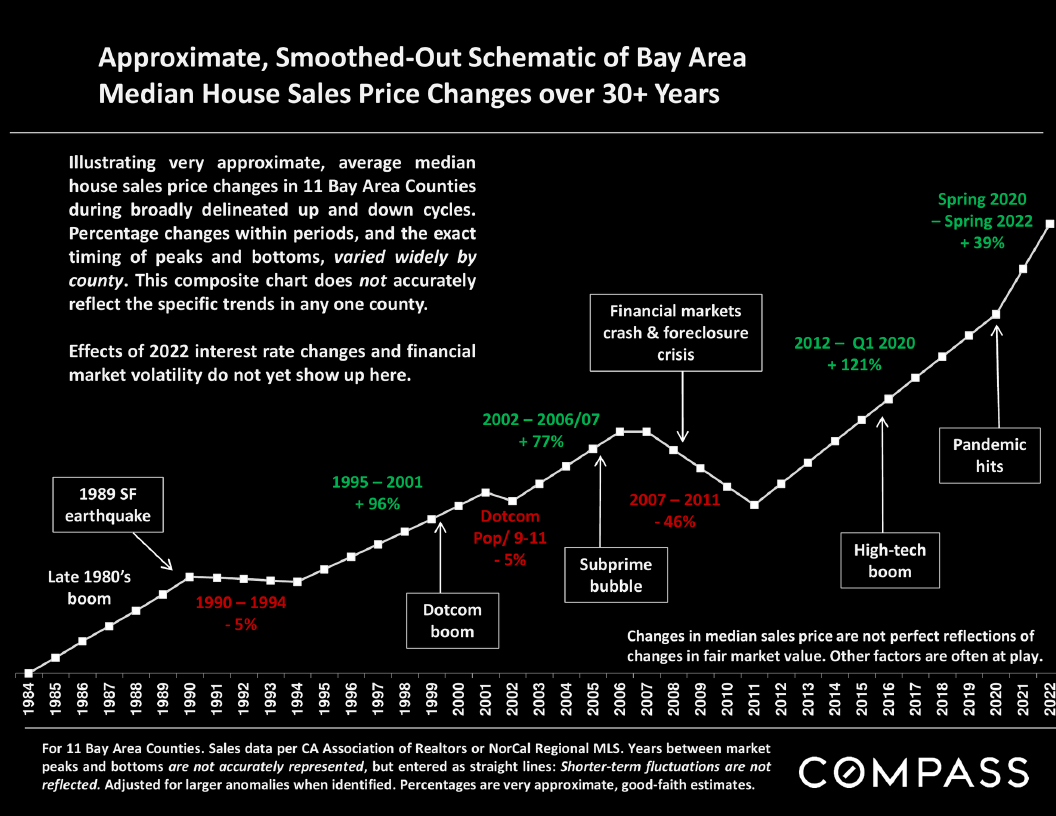

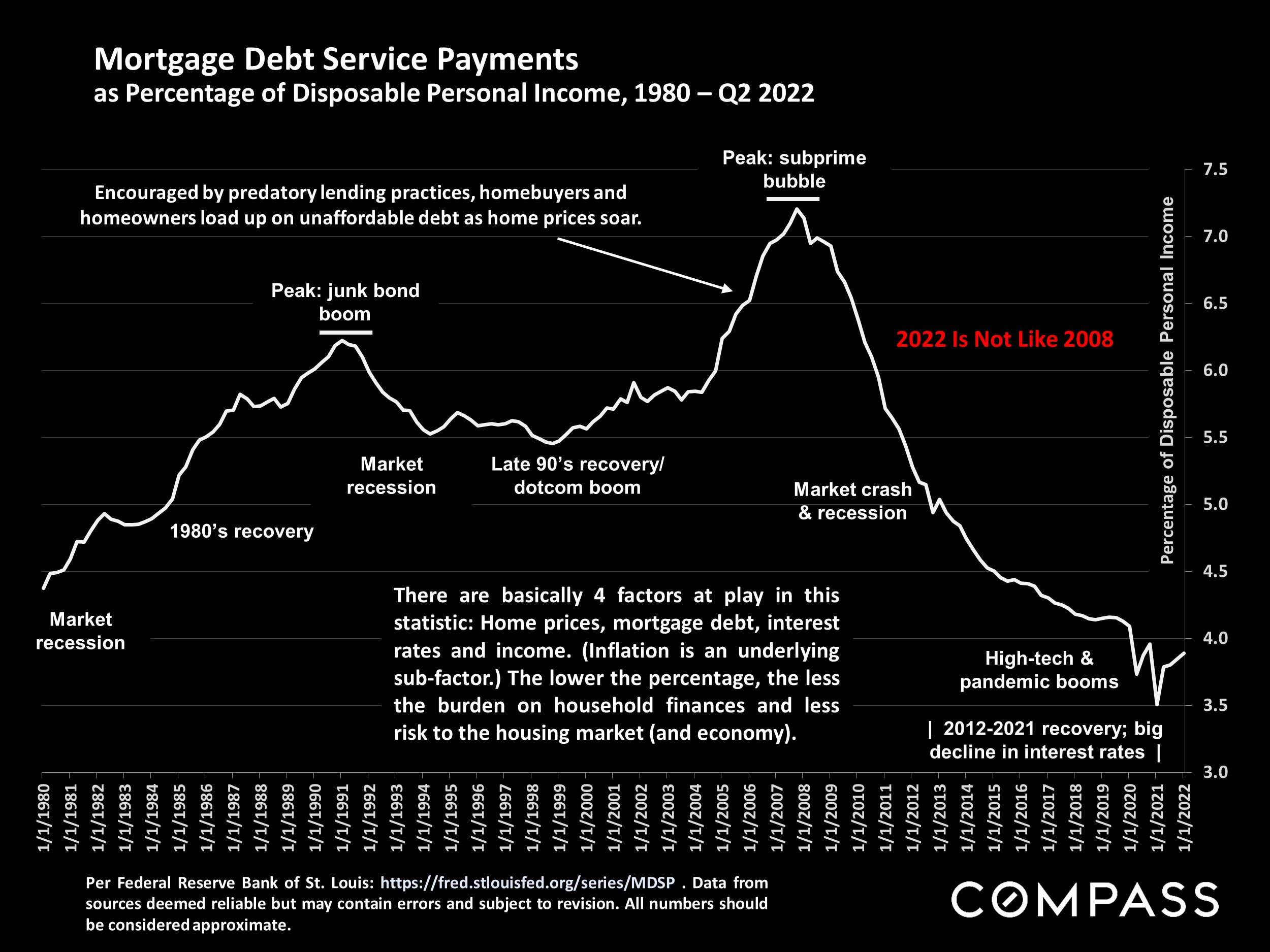

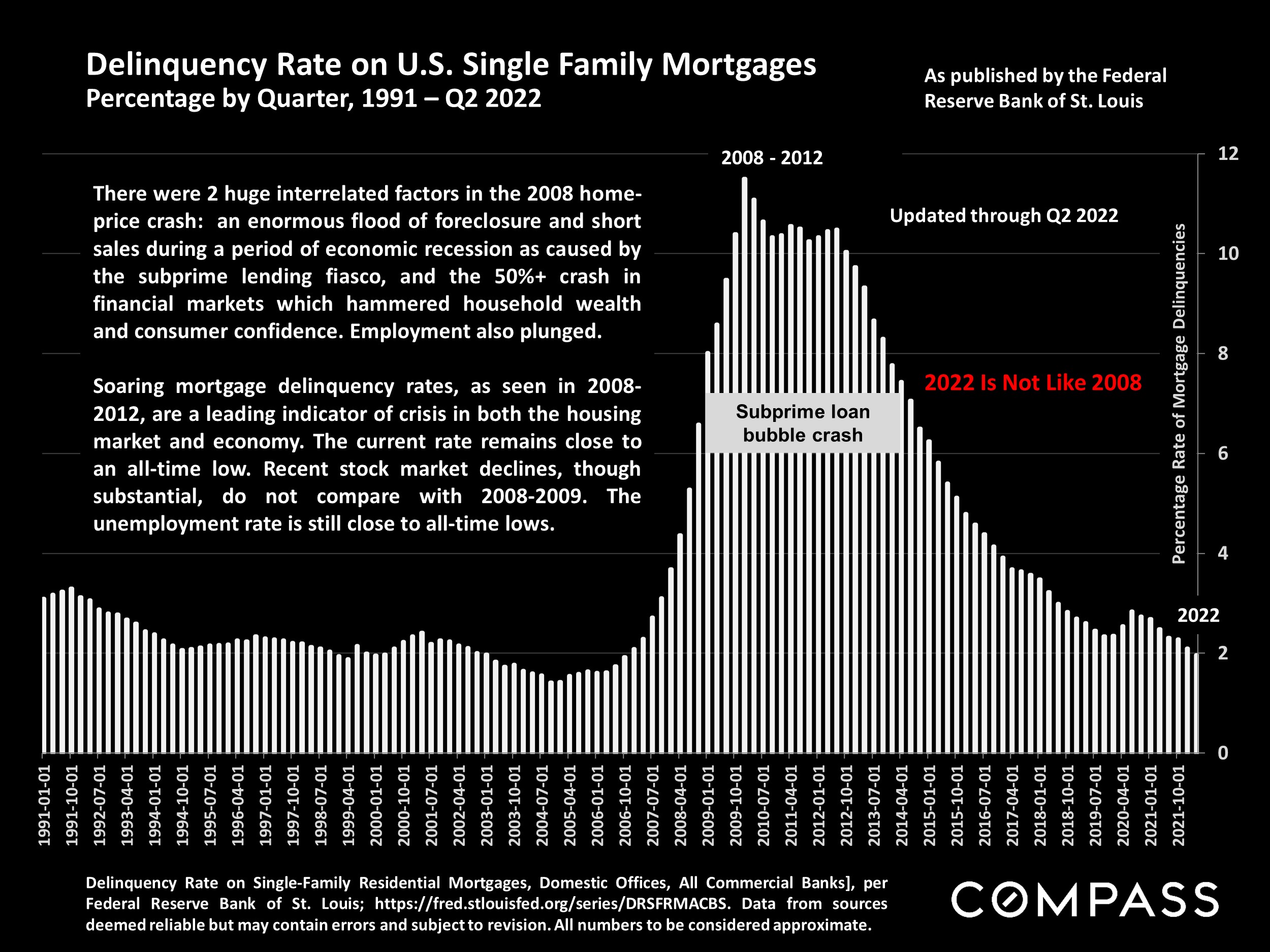

Thank goodness! While our market is seeing a correction, multiple factors that led to the fallout in 2008 are not present now. If you have tried to get a loan in the last ten years, you know how much more stringent the lending qualifications are now. The percentage of personal income to service debt is almost half what it was in 2008 and home prices have risen considerably.

The delinquency rate on mortgages is less than 3% compared to multiple years from 2008-2012 where 1 in 10 mortgages in the US was delinquent. While home prices have slowed their appreciation or dropped slightly, and the equities market has declined this year (though not as precipitously as 2008), employment numbers remain strong.

2. Pricing! Where are we now?

We have all experienced this at different stages in life - no matter how fun a party is, it needs to end sometime. Home prices in the Bay Area have historically followed an up and to the right trend. We have so many important factors that underpin the values in our housing market. If you spent time outside this weekend, the perfect weather (save for the appearance of “Karl the Fog” in San Francisco) is one amongst robust job creation, high wages, access to information and innovation, etc.

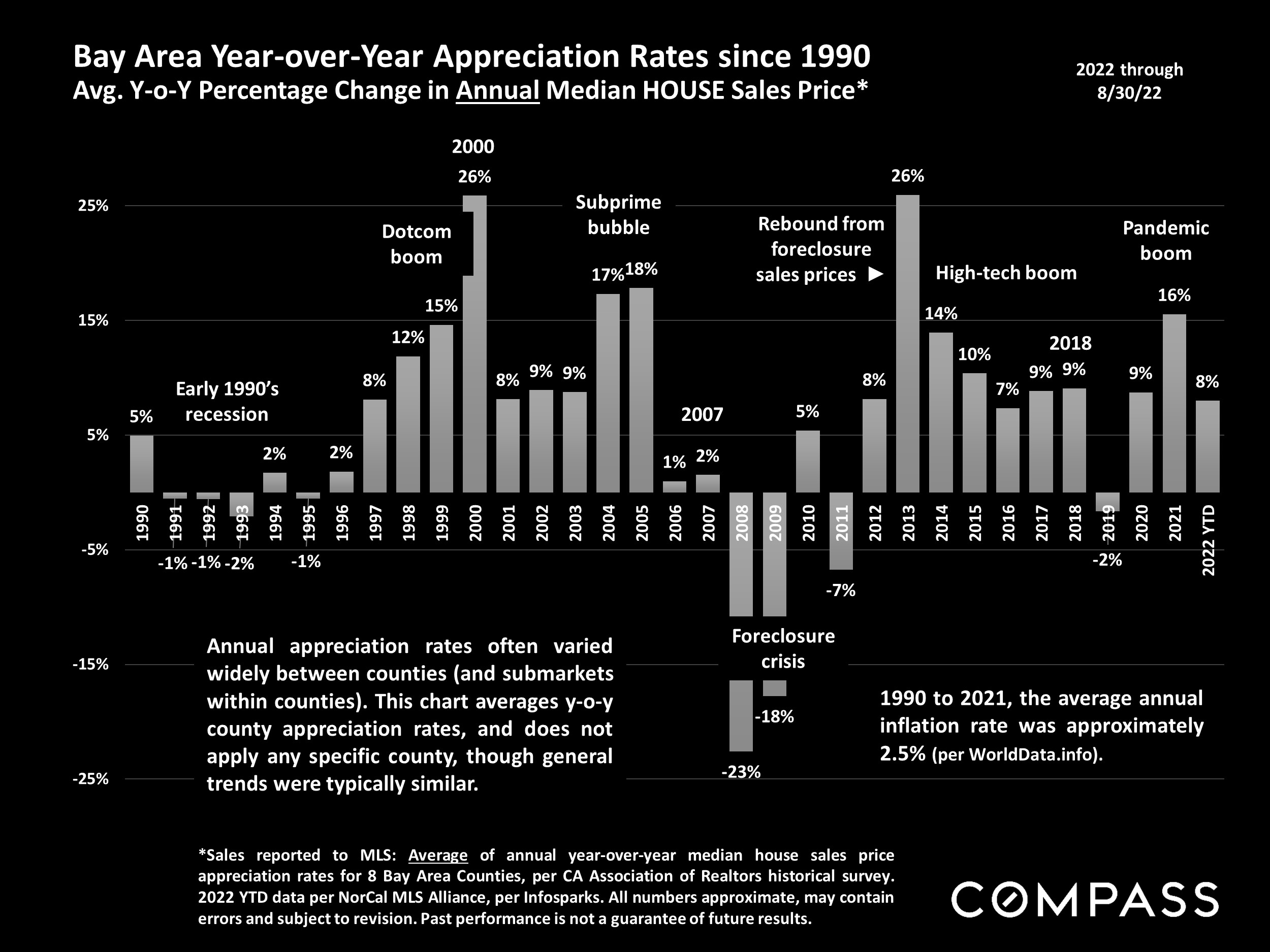

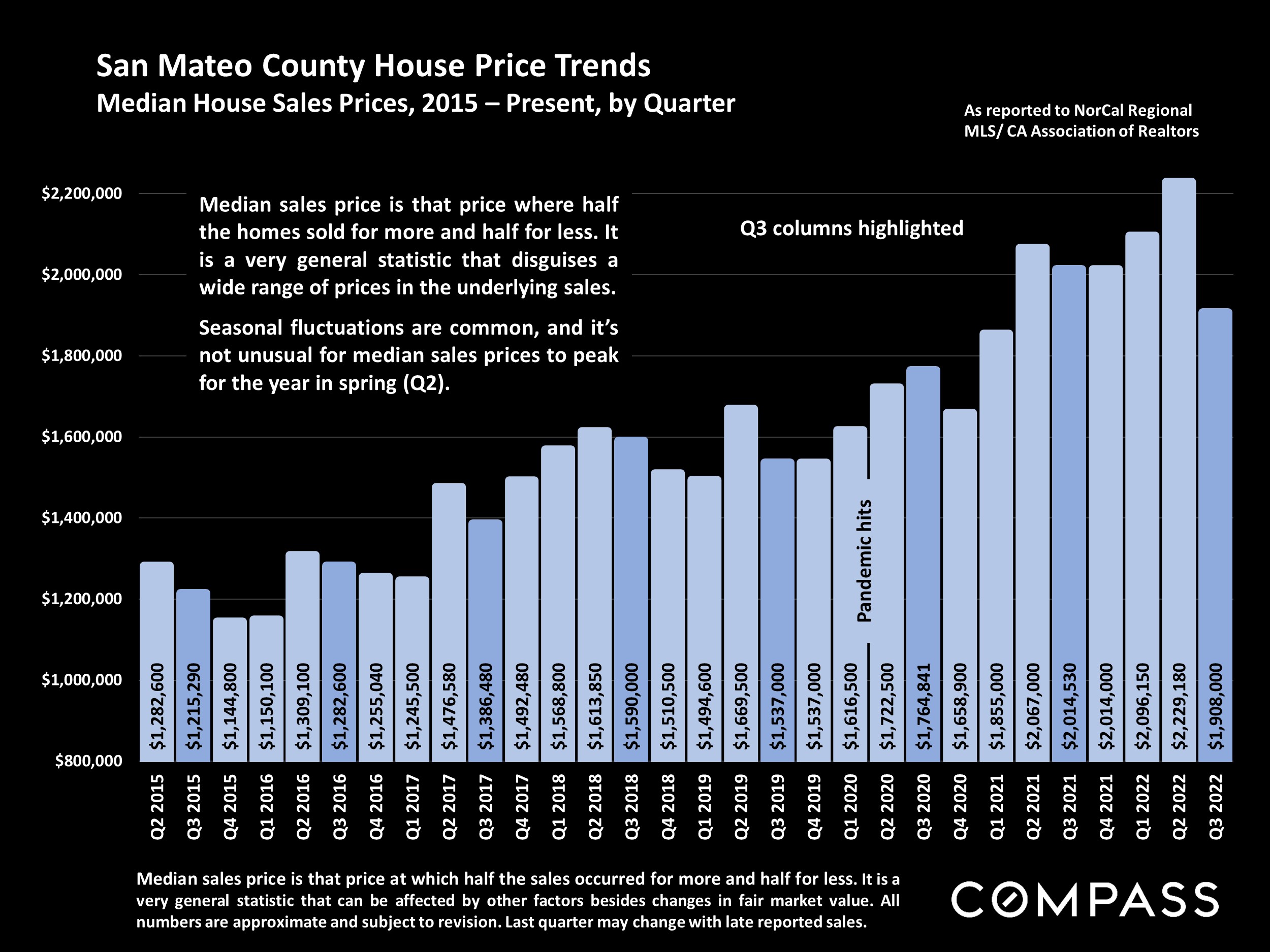

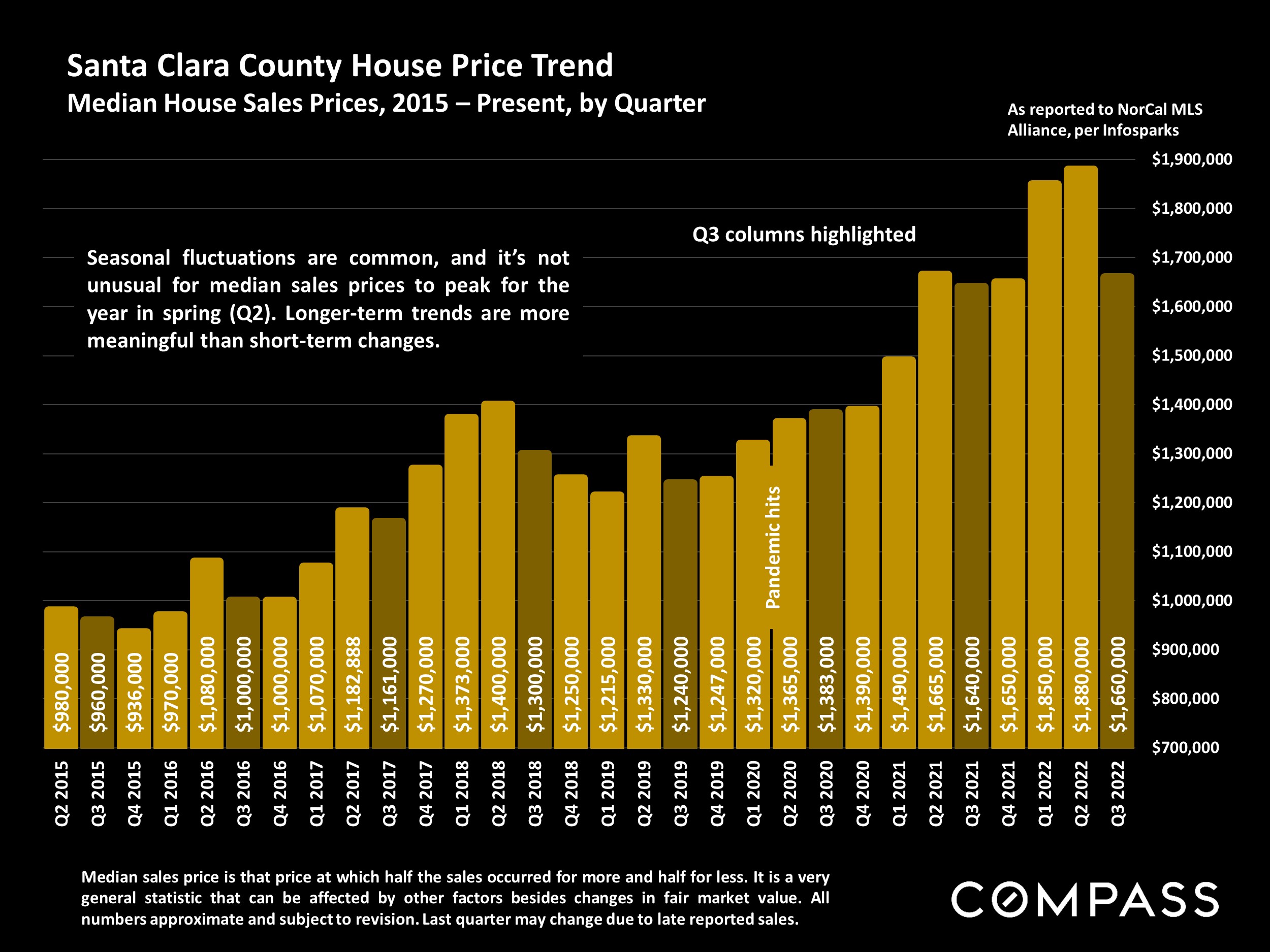

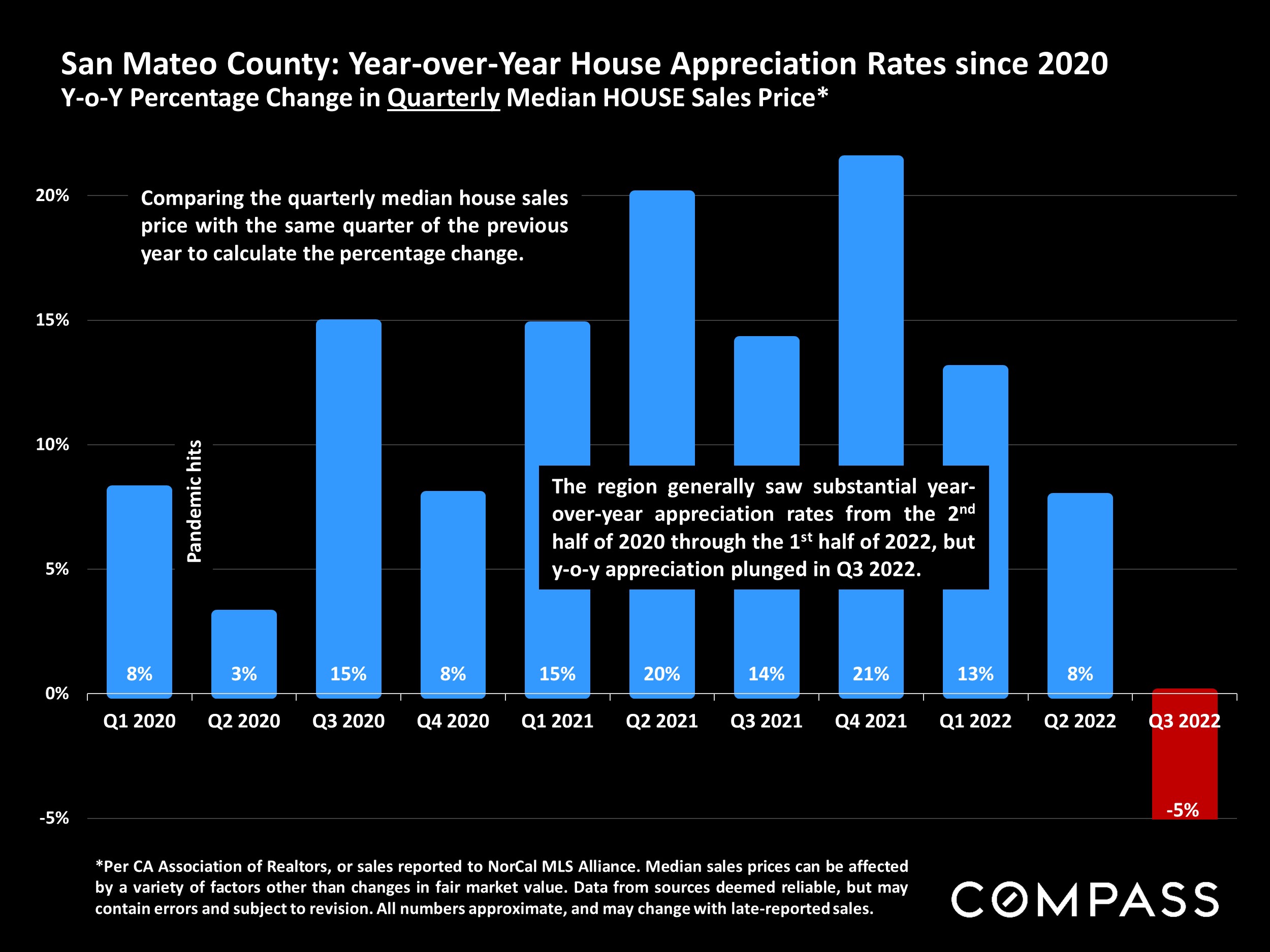

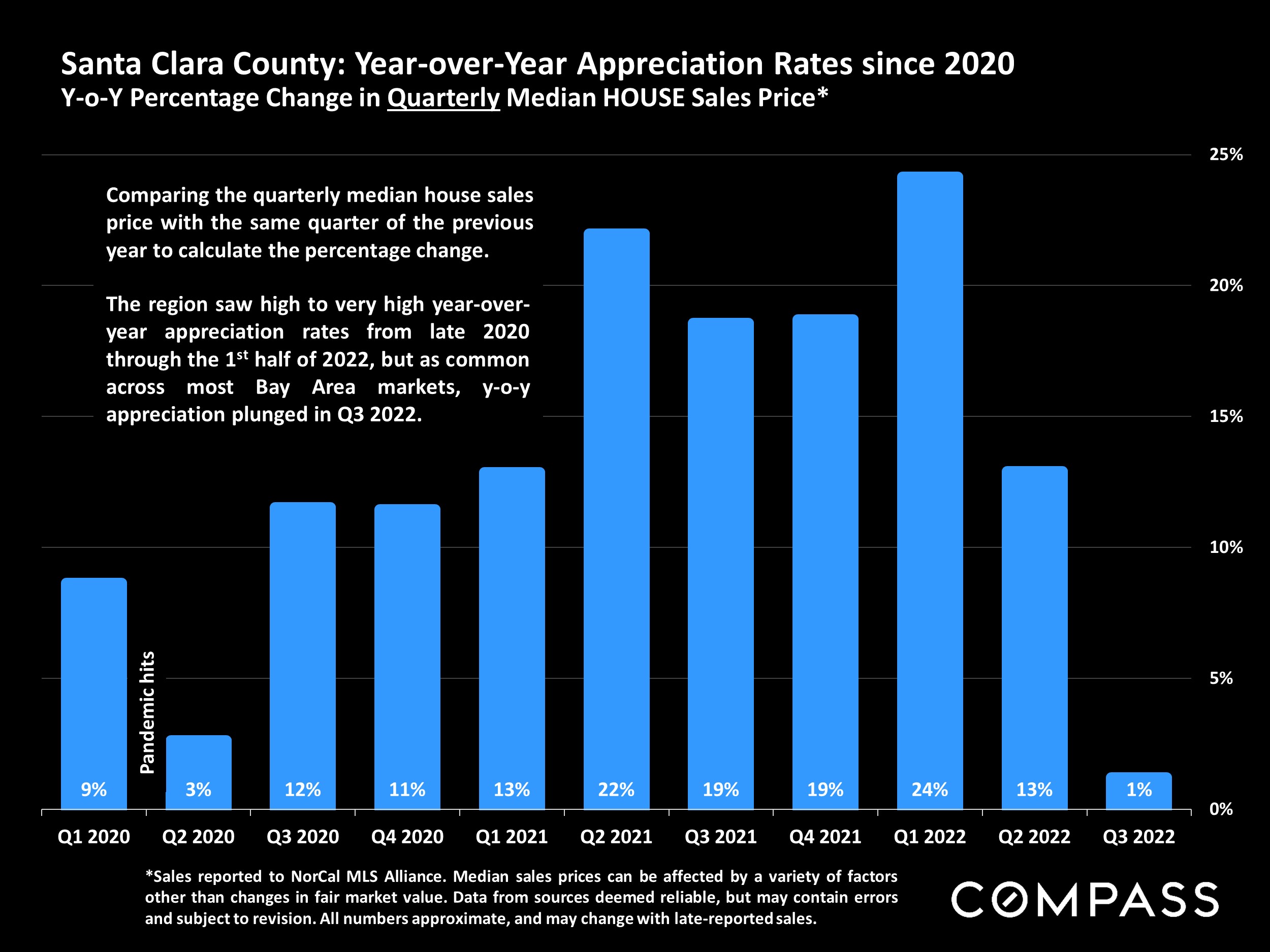

The change in market dynamics since May of this year have shown the “party” of the last two and a half years is winding down. Median price numbers measured on a monthly basis have put the value of homes in San Mateo and Santa Clara Counties back at early 2021 prices. To keep perspective the values in 2021 were significantly higher than prices in 2020 which were higher than the former peak of the market in Q2 2018.

To answer a frequent question - “are prices going down?” The data is showing the homes that are selling are at lower prices than homes that sold earlier this year*. However when we look at the blended appreciation numbers, in Santa Clara county there has been more of a slowing of appreciation than a true drop in prices.

There are a number of factors that affect this blended rate, one of which particularly affected the high end of the market this summer - it seemed like everyone traveled for longer periods of time and activity in the upper end of the market (>$4m slowed considerably from May - Sept).

*The caveat is that great homes in good locations are selling at prices near the spring high watermark.

3. Ch-ch-ch-changes in Market Dynamics

The five charts we are evaluating in this section are indicators of activity in our market, but also call for a change in strategy for agents as we advise clients. We have been blessed with one of the nation’s most efficient markets since coming out of the recession of 2008. List prices were set with the hope (assumption) that there would be multiple offers who could bid up the price. This process often happened in 7-10 days from the time homes went on the market to when an offer was accepted.

Let’s look at some of these numbers to understand what this means for both sellers and buyers.

-

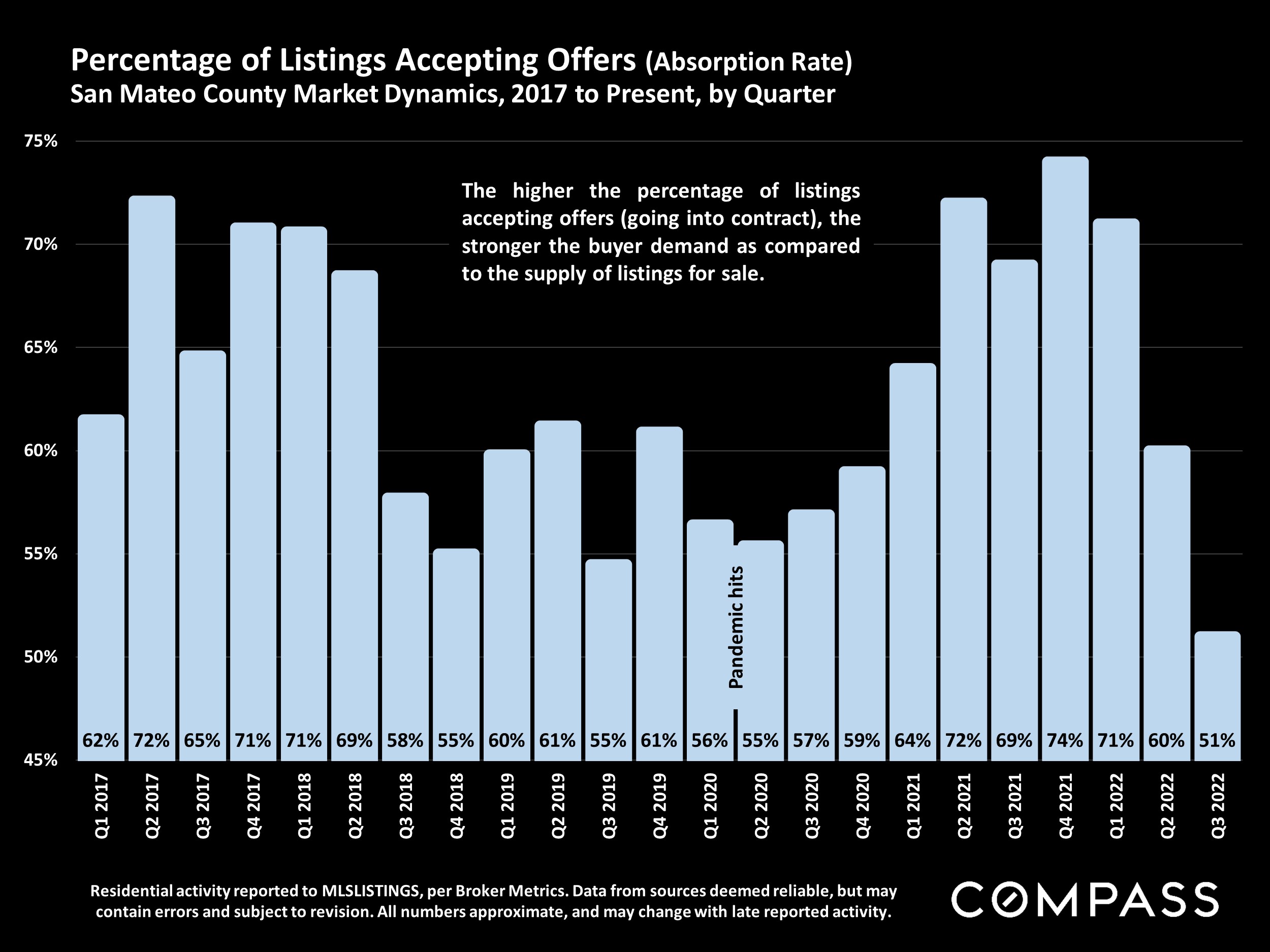

Percentage of Listings Accepting Offers

This shows how quickly homes that are active are being absorbed by the market in the given month. Right now in both counties about half of the homes that are listed will be sold or absorbed in the same month, down from >70% last year. This means there are more choices for buyers and potentially more “slower” moving competition for sellers.

-

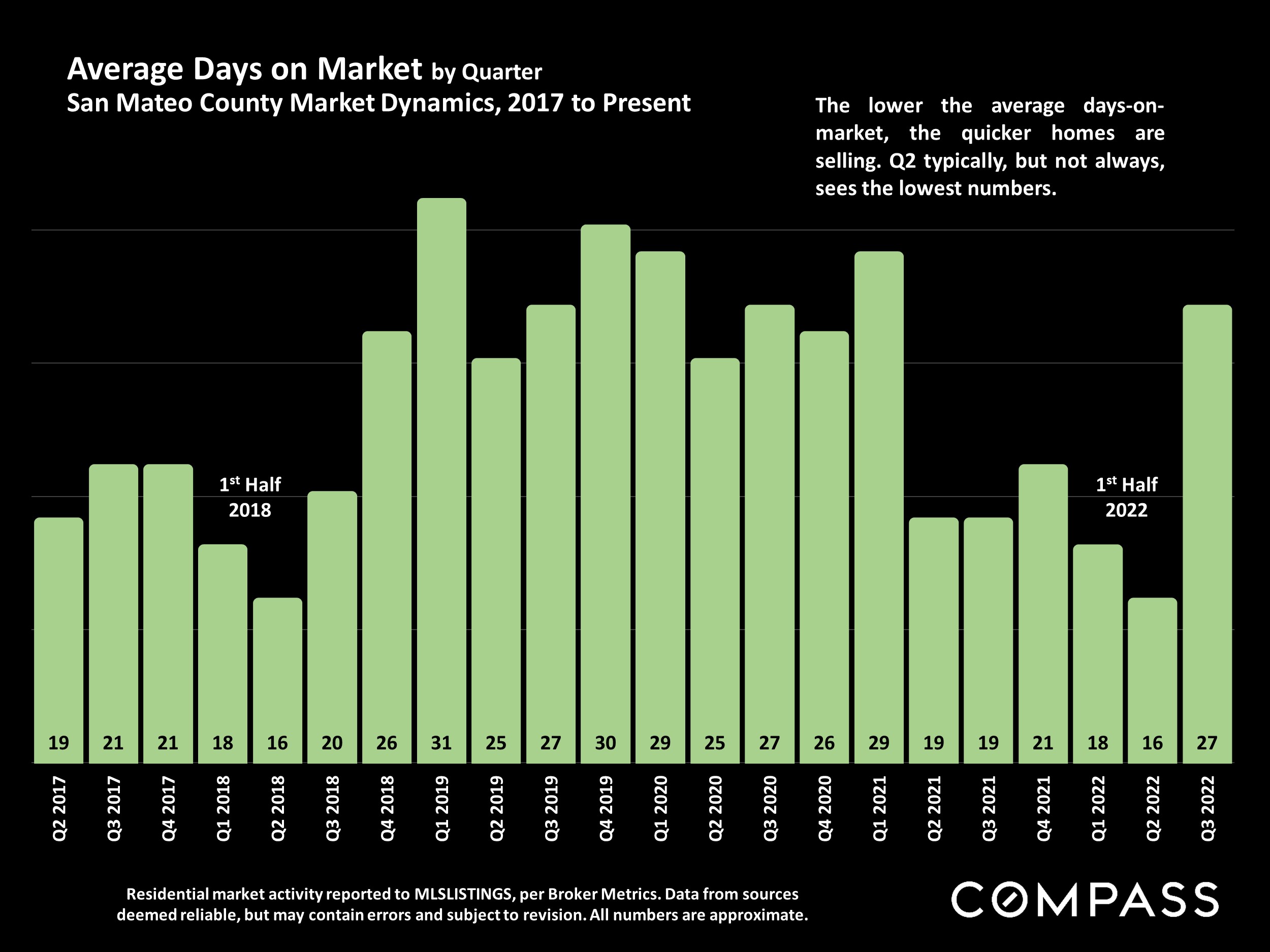

Days on Market (DOM)

This is an obvious indicator that things have slowed down from the peak Q2 spring market - houses are staying on the market longer. In San Mateo the average DOM is up 70% in Q3 and in Santa Clara it is up 100% to 26 days. Read on to see how list price as a strategy can affect DOM.

-

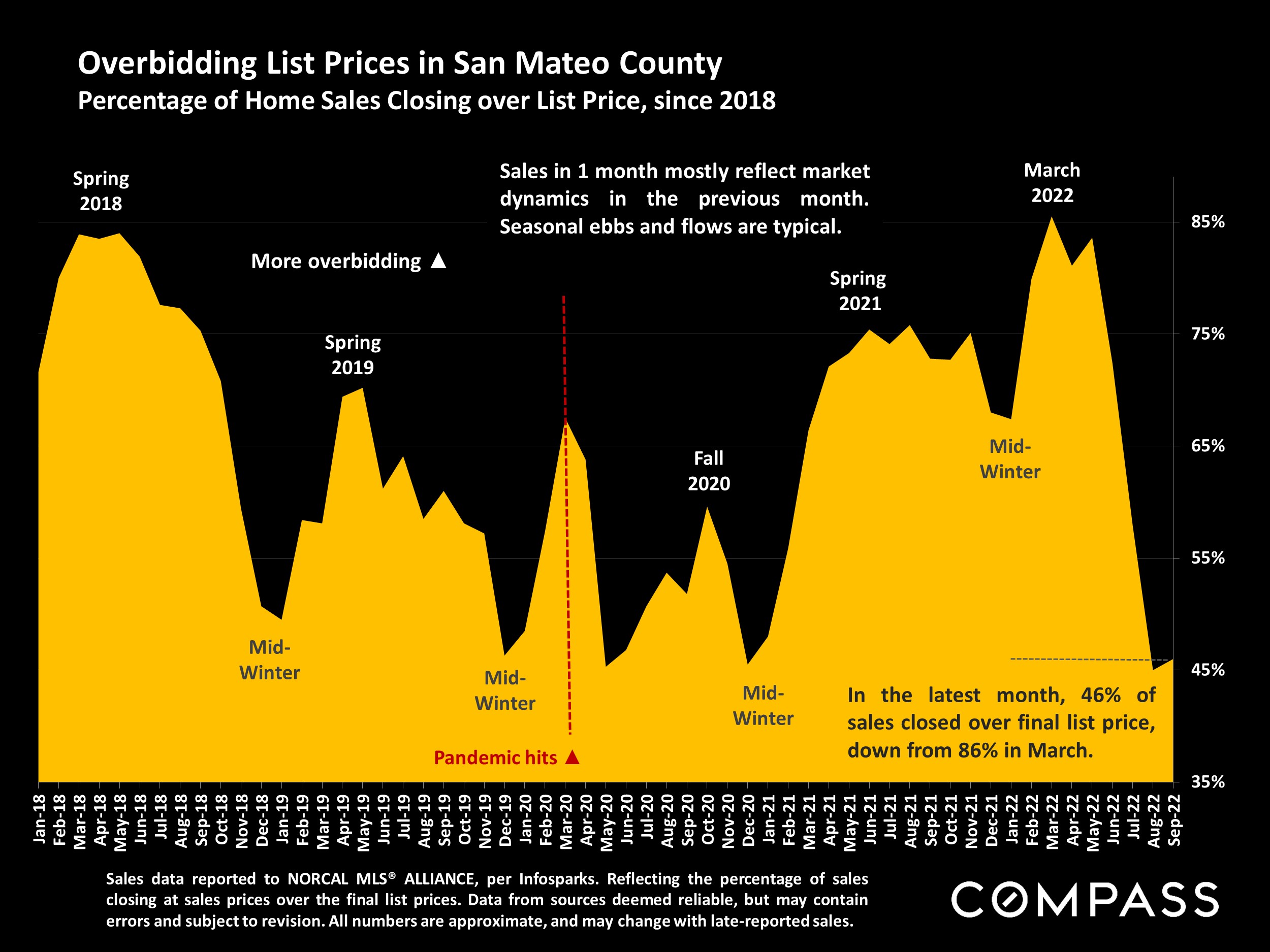

Percentage of Listings Sold over List Price

The next two slides go hand-in-hand to indicate that a change in list price strategy might be necessary. The playbook for many in the last decade was to set the list price so multiple offers would drive up the price. Now, less than 45% of listings in Silicon Valley are seeing that as a successful strategy.

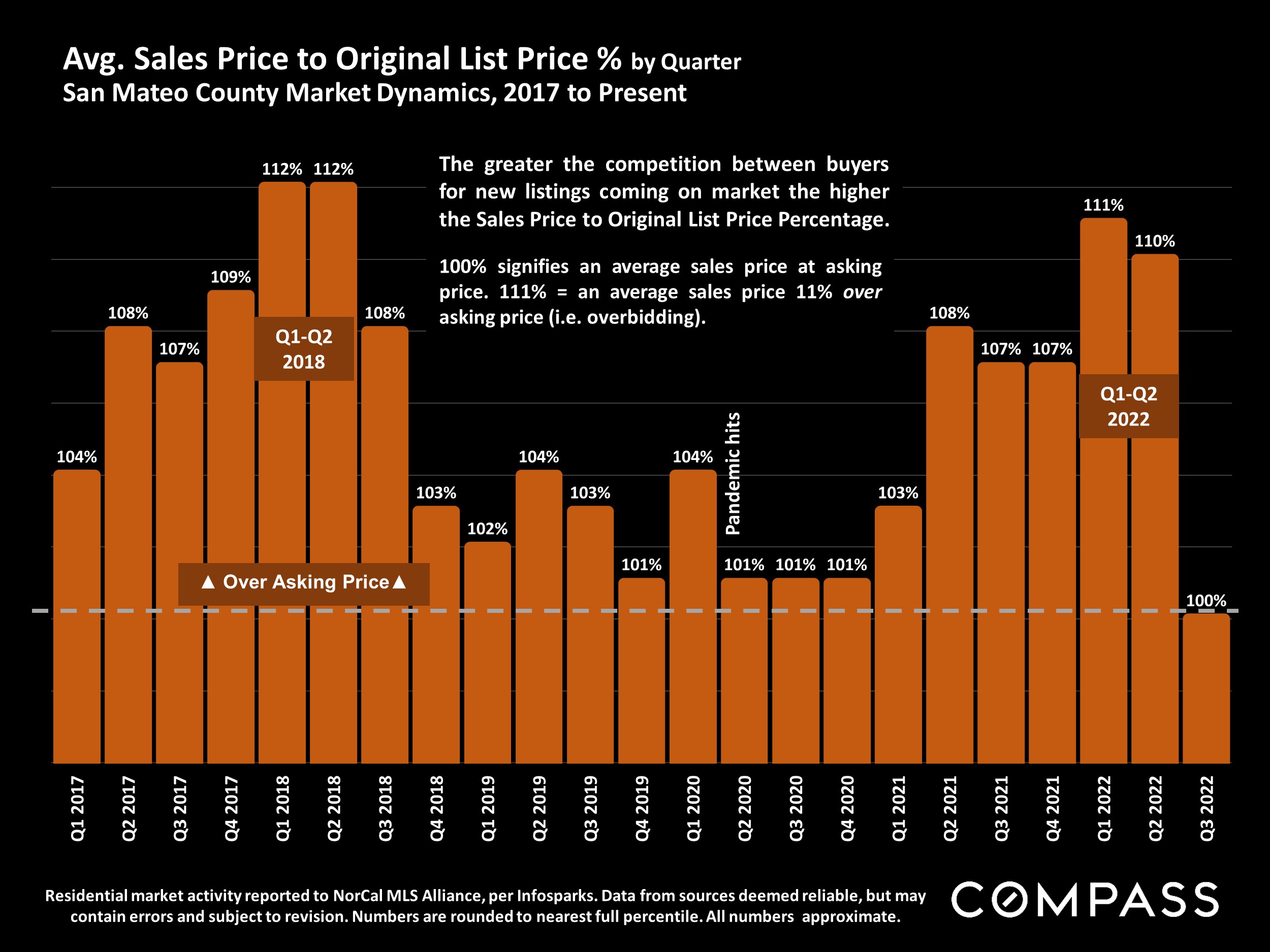

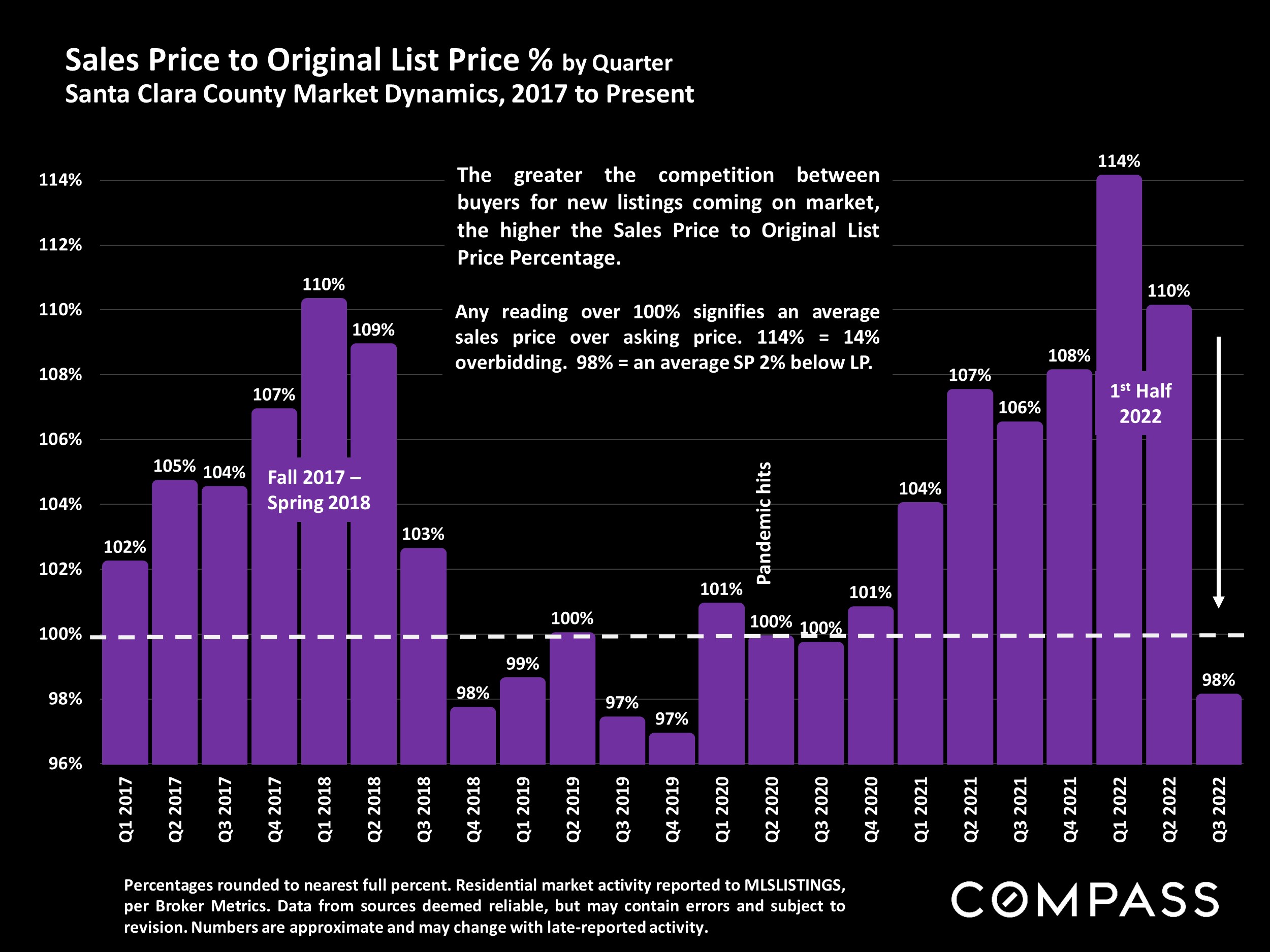

- Sales Price vs. List Price as a percentage

These charts also express how list price as a strategy can affect the outcome. Since there is less certainty in multiple offers, sellers and listing agents are adjusting to price properties closer to their value. This can make it simpler for buyers who aren’t competing against as many other bidders to offer the list price.

-

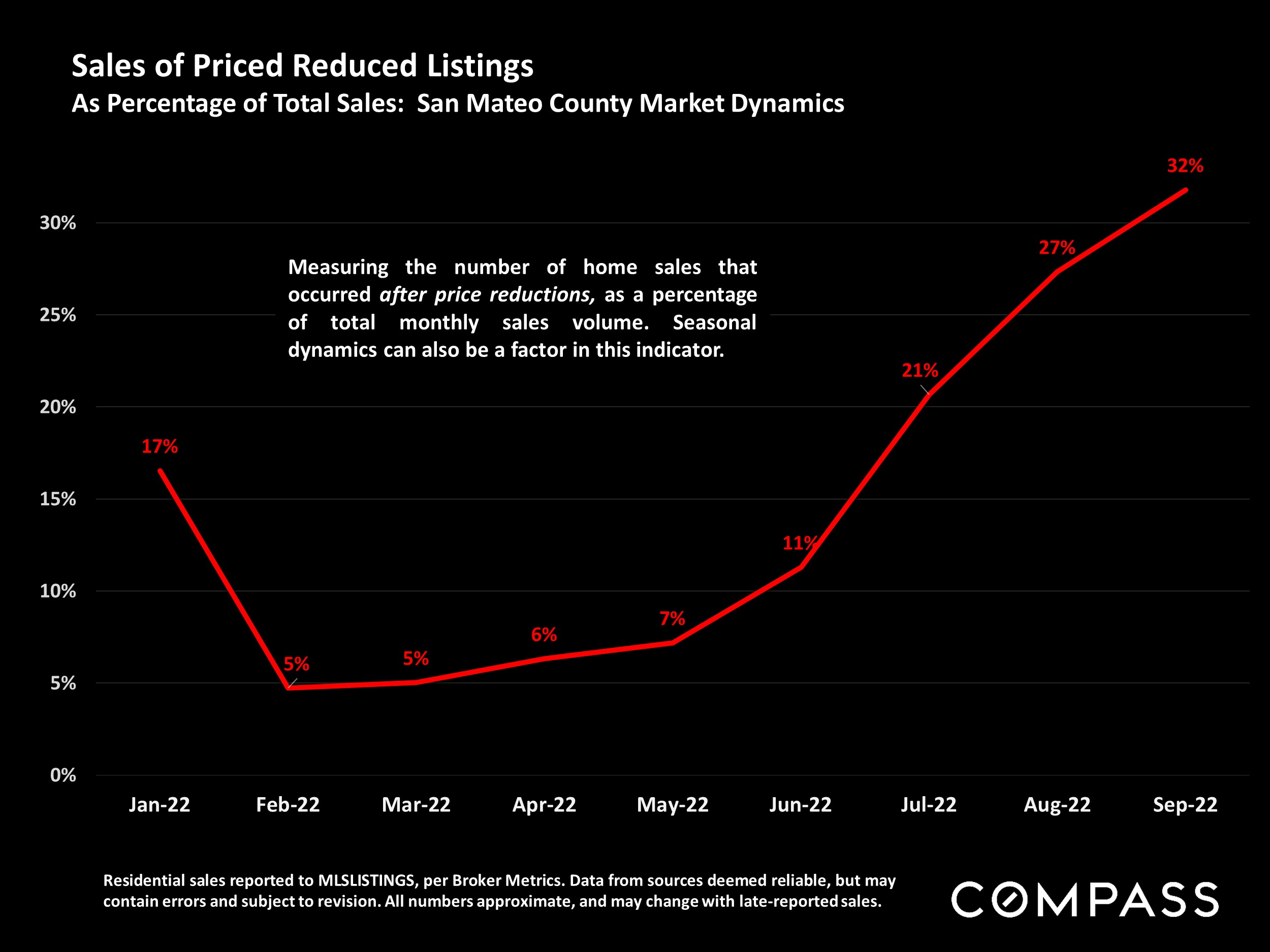

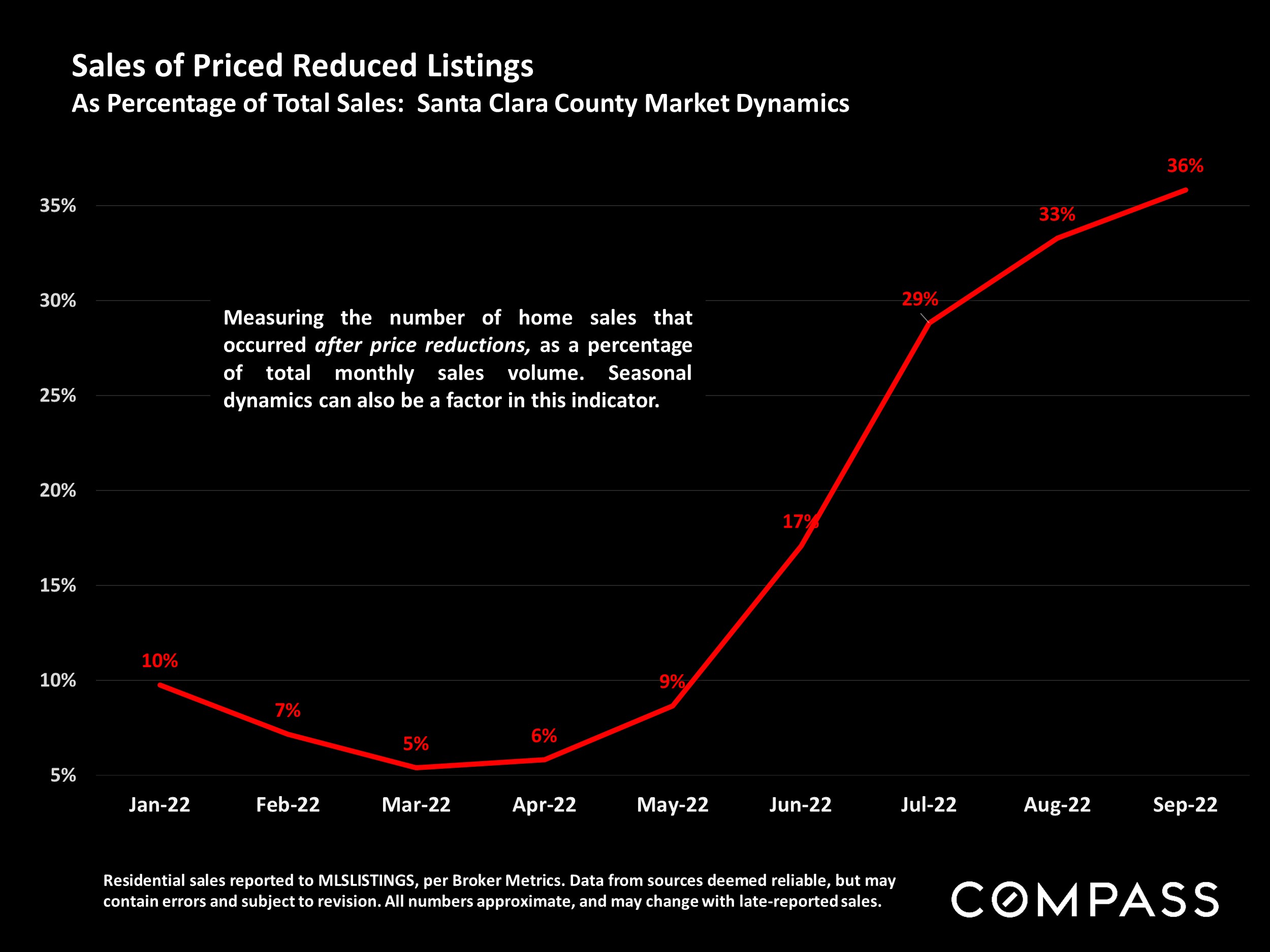

Sales after Price Reductions

This final chart in the market dynamics section is an illustration of how efficient markets are. Almost a third of listings in Silicon Valley sold in September after a price reduction (less than 10% in Q1 and Q2). To us this indicates a lag in adjusting list price strategy to reflect market conditions.

4. Are we inching towards…normal?

We don’t exactly know what “normal” really means, but we do know that life dictates that real estate transactions will continue happening. The reSolve Group is committed to always refining our processes and understanding of market conditions in order to help our clients achieve the best possible results. What has this change meant for our business and guidance for our clients?

On the listing side when we represent sellers, we are seeing that it is even more important to present properties in their best possible light. Buyers have more choices with inventory being up, but they also have less available cash on hand to make improvements after they purchase. In order to stand out and sell quickly, we are advising our clients on the best improvements they can make to deliver a good return on their investment. We are also monitoring the market daily to make sure our list price strategy will lead to an efficient and successful sale.

On the buy side we are enjoying slightly more time to help clients evaluate properties before making a decision on writing an offer. While there are plenty of click-bait “the world is ending” type headlines about the housing market, we help our clients filter out the noise and focus on making a sound decision based on what’s best for them.